LeaderLab

Refine your search by selecting topic (e.g. growth, governance), format (webinar, training), or author.

Toggle to filter resultsAvailable filters:

Changing a filter will refresh results (and remaining options) immediately. Searching by keyword or changing the number of items per page requires use of the "Search" button.

- Aisha Ansano (1)

- Aisha Hauser (1)

- AJ van Tine (1)

- Alice Mann (1)

- All Souls Church Unitarian, Washington, DC (1)

- All Souls UU Church, Kansas City, MO (1)

- Amy Shaw (1)

- Andrea Perry Lerner (3)

- Andrew Pakula (1)

- Anne Odin Heller (1)

- Annie Gonzalez Milliken (1)

- Annie Scott (2)

- Ashley Horan (3)

- Association for Unitarian Universalist Music Ministries (AUUMM) (2)

- Barbara Child (3)

- Barbara Gadon (1)

- Barry Finklestein (8)

- Bart Frost (1)

- Beacon UU Congregation in Summit, Summit, NJ (1)

- Beth Casebolt (7)

- Beth Dana (2)

- Bob Renjilian (1)

- Brent A Smith (1)

- Bull Run UUs, Manassas, VA (1)

- Byron "Tyler" Coles (1)

- Caitlin Breedlove (1)

- Cameron Young (3)

- Carbondale Unitarian Fellowship, Carbondale, IL (1)

- Carey McDonald (4)

- Carlton Elliott Smith (1)

- CB Beal (4)

- Cecilia Kingman (2)

- Cedar Valley Unitarian Universalists, Cedar Falls, IA (1)

- Central East Region of the UUA (33)

- Chip Roush (2)

- Chris Crass (1)

- Christina Leone Tracy (1)

- Christine Robinson (2)

- Christopher L. Walton (1)

- Christopher Wulff (1)

- Church of the Larger Fellowship, Boston, MA (2)

- Cir L’Bert Jr. (1)

- Congregational Life (7)

- Connie Goodbread (7)

- Cora McCold (1)

- Cynthia Kane (1)

- Dan Hotchkiss (4)

- Darcey Elizabeth Hegvik Laine (4)

- Darcy Roake (2)

- Darrick Jackson (1)

- David A Miller (3)

- David H. Messner (1)

- David Pyle (17)

- Davies UU Congregation, Camp Springs, MD (1)

- Deborah Weiner (1)

- Denise T. Davidoff (1)

- Donald E. Skinner (7)

- Dori Davenport Thexton (3)

- Douglas Taylor (1)

- Douglas Zelinski (5)

- DRUUMM (Diverse & Revolutionary UU Multicultural Ministries) (1)

- East Shore Unitarian Church, Bellevue, WA (1)

- Elías Ortega (1)

- Elizabeth Ann Terry (2)

- Ellen Spero (1)

- EqUUal Access (1)

- Erica Baron (10)

- Eric Bliss (2)

- Eric Kaminetzky (1)

- Erika Hewitt (5)

- Erik Walker Wikstrom (1)

- Evin Carvill Ziemer (12)

- First Parish in Lexington, Lexington, MA (1)

- First Unitarian Church, Portland, OR (1)

- First Unitarian Church of Albuquerque, Albuquerque, NM (1)

- First Unitarian Church of Des Moines, Des Moines, IA (1)

- Fredric Muir (1)

- Gail R. Geisenhainer (1)

- George Carvill (1)

- Gilbert Rendle (1)

- Gordon B McKeeman (1)

- Gretchen Maune (1)

- Halcyon Westall (1)

- Heather Bond (1)

- Heather Petit (1)

- Helio Fred Garcia (1)

- Henning Hraban Ramm (1)

- Hilary Allen (2)

- HP Rivers (1)

- Ian Evison (7)

- James Kubal-Komoto (2)

- Jan Christian (5)

- Jan Gartner (45)

- Janice Marie Johnson (1)

- Jason Seymour (1)

- Jay Pacitti (1)

- Jeanelyse Doran Adams (2)

- Jefferson Unitarian Church, Golden, CO (1)

- Jennica Davis-Hockett (3)

- Jennifer Toth Clary (1)

- Jenni Papp (1)

- Jesse Jaeger (1)

- Jill Goddard (1)

- Joanna Fontaine Crawford (1)

- Joe Sullivan (3)

- John A. Buehrens (1)

- Jonipher Kūpono Kwong (8)

- Jordinn Nelson Long (1)

- Joy Berry (1)

- Jules Jaramillo (1)

- Julie Taylor (2)

- Karen Brammer (2)

- Karen G. Johnston (2)

- Karen Lewis Foley (1)

- Karin Lin (1)

- Kasey Kruser (3)

- Kathleen Parker (1)

- Kathleen Rolenz (1)

- Kathy McGowan (9)

- Kay Crider (2)

- Keith Kron (2)

- Kenneth Brown (1)

- Kenneth Hurto (2)

- Kenny Wiley (1)

- Kimberley Debus (1)

- Kimberly Quinn Johnson (1)

- Kim Hampton (1)

- Kim Sweeney (3)

- Larry Ladd (2)

- Larry Stritof (1)

- Laura Beth Brown (1)

- Laura Park (4)

- Laura Randall (1)

- Lauren Smith (1)

- Leah Ongiri (1)

- Leon Spencer (1)

- Leslie Takahashi (1)

- Liberal Religious Educators Association (1)

- Lifespan Faith Engagement (1)

- Lisa Bovee-Kemper (2)

- Lisa Presley (12)

- Liz Coit (2)

- Liz James (1)

- LoraKim Joyner (2)

- Lori Emison Clair (2)

- Lori Stone (2)

- Louise Green (1)

- Lucia Santini Field (1)

- Margaret A Keip (1)

- Margaret L. Beard (1)

- Margy Levine Young (1)

- Marie Luna (3)

- Mark Bernstein (18)

- Mark Hicks (2)

- Mark V. Ewert (2)

- Mary Byron (1)

- Mary Katherine Morn (1)

- Matthew Johnson (1)

- Meck Groot (4)

- Megan Foley (8)

- Meg Riley (1)

- Melanie Davis (2)

- Melissa James (1)

- Michael J. Crumpler (1)

- Michael J. Tino (1)

- Michelle Richards (2)

- MidAmerica Region of the UUA (58)

- Mykal Slack (1)

- Nancy Bowen (1)

- Nancy Combs-Morgan (7)

- Nancy Heege (2)

- Natalie Briscoe (1)

- Natalie Maxwell Fenimore (1)

- Neighborhood UU Church of Pasadena, Pasadena, CA (1)

- New England Region of the UUA (8)

- Nicole Duff (1)

- Northlake UU Church, Kirkland, WA (1)

- Pacific Unitarian Church, Rancho Palos Verdes, CA (1)

- Pacific Western Region of the UUA (10)

- Pastor Danny Givens (2)

- Patrice K. Curtis (2)

- Patricia Infante (28)

- Paula Cole Jones (9)

- Peter Bowden (3)

- Peter Morales (2)

- Phillip Lund (9)

- Qiyamah Rahman (1)

- Quimper UU Fellowship, Port Townsend, WA (1)

- Rachel Maxwell (2)

- Ranwa Hammamy (1)

- Rayla D. Mattson (1)

- Renee Ruchotzke (167)

- Rev. Molly Brewer (1)

- Richard Nugent (9)

- Richard S. Gilbert (1)

- Richard Speck (1)

- River Road UU Congregation, Bethesda, MD (1)

- Robert L. Eller-Isaacs (3)

- Robin Bartlett (1)

- Rob Molla (2)

- Rosemary Bray McNatt (1)

- Safe Congregations Team (2)

- Sana Saeed (5)

- Sarah Gibb Millspaugh (19)

- Sarah Lammert (2)

- Sarah Movius Schurr (13)

- Scott Tayler (4)

- Seanan R. Holland (1)

- Sean Griffin (5)

- Shannon Harper (2)

- Sharon Dittmar (10)

- Sheila Schuh (1)

- Shelby Meyerhoff (1)

- Skinner House Books (1)

- Sofía Betancourt (1)

- Southern Region of the UUA (6)

- Stefan Jonasson (7)

- Steve Bridenbaugh (1)

- Steven Leigh Williams (1)

- Stewardship for Us (11)

- Sue Phillips (3)

- Summer Albayati (1)

- Sunshine Jeremiah Wolfe (5)

- Susan Frederick-Gray (2)

- Susanne Intriligator (1)

- Suzanne Meyer (1)

- Tandi Rogers (19)

- Tera Little (2)

- Terasa Cooley (1)

- The First Unitarian Church of Dallas, Dallas, TX (2)

- Thom Belote (1)

- Tim Byrne (1)

- Tom Schade (1)

- Unitarian Church of Harrisburg, Harrisburg, PA (1)

- Unitarian Universalist Association of Membership Professionals (6)

- Unitarian Universalist Ministers Association (UUMA) (1)

- Unitarian Universalists San Luis Obispo, San Luis Obispo, CA (1)

- Unity Temple UU Congregation, Oak Park, IL (1)

- Universalist Unitarian Church of Peoria, Peoria, IL (1)

- UUA Commission on Appraisal (COA) (1)

- UUA Congregational Life: Growth Strategies For Congregations Office (1)

- UUA Credentialing and Professional Development, Ministries and Faith Development (1)

- UUA Human Resources (1)

- UUA Information Technology Service Staff Group (2)

- UUA Office of Church Staff Finances, Ministries and Faith Development (21)

- UUA Outreach and Public Witness, Communications (6)

- UU Area Church at First Parish Sherborn, Sherborn, MA (1)

- UUA Stewardship and Development (2)

- UUA Web Team, Information Technology Services (7)

- UU Church of Akron, Fairlawn, OH (2)

- UU Church of Annapolis, Annapolis, MD (1)

- UU Church of Berkeley, Kensington, CA (1)

- UU Church of Bloomington, Indiana, Bloomington, IN (1)

- UU Church of Delaware County, Media, PA (1)

- UU Church of Tallahassee, Tallahassee, FL (1)

- UU Congregation of Binghamton, Binghamton, NY (3)

- UU Congregation of Fairfax, Oakton, VA (1)

- UU Congregation of South County, Peace Dale, RI (1)

- UU Fellowship of Beaufort, Beaufort, SC (1)

- UU Fellowship of Wayne County Ohio, Wooster, OH (1)

- UU Leadership Institute (5)

- UU Society for Community Ministries (1)

- UU Trauma Response Ministry (1)

- UU University (1)

- Vail Weller (2)

- Warren Brown (1)

- Washington Ethical Society, Washington, DC (2)

- Wayne B. Arnason (1)

- Wayne B. Clark (1)

- West Shore UU Church, Rocky River, OH (1)

- Westside UU Congregation, Seattle, WA (1)

- White Bear UU Church, Mahtomedi, MN (1)

- William Clontz (3)

- William E Gardner (2)

- Woullard Lett (1)

- Wren Bellavance-Grace (7)

- #8thPrinciple (3)

- #BlackLivesMatter (1)

- #COVID19 (116)

- #WidenTheCircle (9)

- 3rd Principle (Acceptance & Spiritual Growth) (1)

- 5th Principle (Conscience & Democracy) (1)

- Brokenness (1)

- Career Development for Ministers (2)

- Children (2)

- Christianity (1)

- Coming-of-Age (1)

- Coming of Age (1)

- Communication (72)

- Congregational Administration (16)

- Copyright Permissions (3)

- Covenant (1)

- Death (3)

- Disability & Accessibility (28)

- Disaster or Crisis (1)

- Emerging Ministries (3)

- Faith Development

(31)

- Adult Faith Development (26)

- Children's Faith Development (11)

- Covenant Groups & Small Group Ministry (21)

- Families & Faith Development (18)

- High School-Aged Youth Faith Development (13)

- Middle School-Aged Youth Faith Development (3)

- Multigenerational Faith Development (10)

- Spiritual Practice (1)

- Young Adult Faith Development (ages 18-35) (4)

- Youth Ministry (13)

- Family (1)

- Family Programs (1)

- Finance for Congregations (43)

- General Assembly (5)

- Giving & Generosity (6)

- Governance for Congregations (59)

- Gratitude (1)

- Grief (4)

- Healing (1)

- Hope (1)

- Hospitality (1)

- Humility (1)

- Inclusion (1)

- Interdependence (1)

- Kwanzaa (1)

- Large Congregations (3)

- Leadership (1)

- Leadership Development (68)

- Membership Growth & Outreach (136)

- Memorial Services (4)

- Mental Health (1)

- Mid-Size Congregations (2)

- Nourishing the Spirit (5)

- Pain (1)

- Parents (3)

- Principles and Purposes (1)

- Professional Development for Religious Educators (12)

- Rites of Passage (11)

- Safe Congregations (31)

- Self-Care (1)

- Small Congregations (50)

- Social Justice

(13)

- Spiritual Practice (1)

- Suffering (1)

- Support and Caring in Congregations (3)

- Trauma (1)

- Unitarian Universalism (1)

- UUA Governance & Management (1)

- UU History (5)

- UU Identity (7)

- UU Theology (8)

- Welcome & Inclusion for LGBTQ (1)

- Wholeness (1)

- Worship (34)

- Worth (1)

- #8thPrinciple (3)

- #BlackLivesMatter (1)

- #COVID19 (116)

- #WidenTheCircle (9)

- 3rd Principle (Acceptance & Spiritual Growth) (1)

- 5th Principle (Conscience & Democracy) (1)

- Adults (14)

- Brokenness (1)

- Career Development for Ministers (2)

- Children (2)

- Christianity (1)

- Coming-of-Age (1)

- Coming of Age (1)

- Communication (72)

- Congregational Administration (16)

- Copyright Permissions (3)

- Covenant (1)

- Death (3)

- Disability & Accessibility (28)

- Disaster or Crisis (1)

- Emerging Ministries (3)

- Faith Development

(31)

- Adult Faith Development (26)

- Children's Faith Development (11)

- Covenant Groups & Small Group Ministry (21)

- Families & Faith Development (18)

- High School-Aged Youth Faith Development (13)

- Middle School-Aged Youth Faith Development (3)

- Multigenerational Faith Development (10)

- Spiritual Practice (1)

- Young Adult Faith Development (ages 18-35) (4)

- Youth Ministry (13)

- Family (1)

- Family Programs (1)

- Finance for Congregations (43)

- General Assembly (5)

- Giving & Generosity (6)

- Governance for Congregations (59)

- Gratitude (1)

- Grief (4)

- Healing (1)

- Hope (1)

- Hospitality (1)

- Humility (1)

- Inclusion (1)

- Interdependence (1)

- Kwanzaa (1)

- Large Congregations (3)

- Leadership (1)

- Leadership Development (68)

- Membership Growth & Outreach (136)

- Memorial Services (4)

- Mental Health (1)

- Mid-Size Congregations (2)

- MidAmerica Region (3)

- New England Region (2)

- Nourishing the Spirit (5)

- Ohio (3)

- Pain (1)

- Parents (3)

- Principles and Purposes (1)

- Professional Development for Religious Educators (12)

- Rites of Passage (11)

- Safe Congregations (31)

- Self-Care (1)

- Small Congregations (50)

- Social Justice

(13)

- Spiritual Practice (1)

- Suffering (1)

- Support and Caring in Congregations (3)

- Trauma (1)

- Unitarian Universalism (1)

- UUA Governance & Management (1)

- UU History (5)

- UU Identity (7)

- UU Theology (8)

- Welcome & Inclusion for LGBTQ (1)

- Wholeness (1)

- Worship (34)

- Worth (1)

Displaying 21 - 40 of 1032

-

While the requirements for membership are in your bylaws, you also need policies ithat define participation, financial support, etc.Leader Resource | November 13, 2023 | From LeaderLabTagged as: Bylaws & Policies, Membership in Congregations

-

Gift card — also known as "scrip" — fundraising is another opportunity for people to stay within their budgets while still helping the congregation's bottom line.By Renee Ruchotzke | November 10, 2023 | From LeaderLabTagged as: Fundraising for Congregations

-

A tiny church cannot have a dozen or so teams or committees that a bigger congregation has. Really, we can only do one thing at a time.By Darcey Elizabeth Hegvik Laine | November 2, 2023 | From LeaderLabTagged as: Small Congregations, Worship

-

What if the space we need to live our mission no longer matches the building we own? Could our building find a new calling?By Darcey Elizabeth Hegvik Laine | October 25, 2023 | From LeaderLabTagged as: Facilities Management

-

Involuntary terminations are never easy. Ensure the best possible outcomes for the congregation while offering kindness and respect to the employee. This is a chance for the congregation leadership to practice UU values.By Jan Gartner | October 24, 2023 | From LeaderLabTagged as: Staffing & Supervision

-

Anticipate and plan for how to respond to violent threats, vandalism, doxxing, and other forms of intimidation and harassment.Training | By Sunshine Jeremiah Wolfe | October 21, 2023 | From LeaderLabTagged as: Trauma and Disaster Response

-

A team from the UU Church of Akron, Ohio created this series of teaching videos to help others learn how to avoid microaggressions in their interactions.Congregational Story | By UU Church of Akron, Fairlawn, OH | October 18, 2023 | From LeaderLabTagged as: Welcome & Inclusion for LGBTQ

-

The UUA doesn’t dictate any particular governance model, but congregations have historically explored new models in "waves."By Renee Ruchotzke | October 16, 2023 | From The Congregational HandbookTagged as: Governance for Congregations

-

When you’re a member of a vibrant congregation, you hope for a deep and radical welcome there. You want to be able to bring your whole self, and feel called to be your best self, accountable to the vision of beloved community the community shares. In these congregations, when actions, words, or...Training | September 21, 2023 | From LeaderLabTagged as: Covenant, Safe Congregations

-

Practice radical inclusion by assuming that at least one young person you know will experience a mental health challenge this year. There are plenty of trainings so you can skill up your support.September 18, 2023 | From Youth MinistryTagged as: High School-Aged Youth Faith Development

-

Based on the theology of Creative Interchange, this training is for teams who have the honor of co-creating meaning while shaping the worship experience of the congregation.Training | By Erika Hewitt | September 13, 2023 | From LeaderLabTagged as: Worship Tips

-

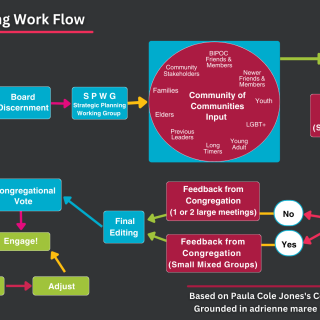

If we thought of our congregations as a community of communities, rather than a family, we can shift our self understanding in way that is more inclusive and expansive.Video | By Paula Cole Jones | September 12, 2023 | From LeaderLabTagged as: Membership Growth & Outreach

-

Coming of Age Conversations from Threshold Project panels, writings, and moreSeptember 12, 2023 | From Call and ResponseTagged as: Coming of Age, Coming-of-Age, Middle School-Aged Youth Faith Development, UU Theology, Professional Development for Religious Educators

-

When your congregation is developing or revisiting "guiding documents" for leaders that are endorsed by the congregation as a whole (e.g....Leader Resource | By Renee Ruchotzke | September 11, 2023 | From LeaderLabTagged as: Mission/Vision/Planning

-

For congregations that own a parsonage, consider the possibilities as well as implications for structuring a ministerial agreement.Leader Resource | By Sean Griffin, Jan Gartner | August 29, 2023 | From LeaderLabTagged as: Benefits & Compensation for Congregations, Support for Ministers

-

In this seven-part series, participants are introduced to Spiritual Leadership and its five practices: Covenanting, Tending Our Tradition, Doing Our Inner Work, Centering in Gifts, and Faithful Risking. The series centers on questions faithful people are asking: "How can we more actively imagine,...August 21, 2023 | From New England Region

-

Sermon of the Month Series Subscription Service: Offered By Your UUA Congregational Life Field StaffThe Sermon of the Month series is a monthly subscription service that provides recorded sermons congregations can download and use for worship. Along with a transcript of the sermon, each month’s offering will include suggested readings and hymns.By Congregational Life | August 21, 2023 | From LeaderLabTagged as: Worship

-

Our spiritual communities are at their best when we support one another. In order to support young adults with mental health issues well, we need to fight the stigma, watch for signs, reach out proactively, and maintain healthy boundaries....August 11, 2023 | From Youth MinistryTagged as: High School-Aged Youth Faith Development, Mental Health

-

This “next level” training for boards goes into its roles as fiduciary agents, spiritual leaders, strategic thinkers, and change agents.Training | By Congregational Life | August 1, 2023 | From LeaderLabTagged as: Governing Boards

-

A few weeks ago, I joined Joe, Meck, and our Region’s Spiritual Leadership for Culture Change Community of Practice (join anytime!) for a conversation on Tending Our Tradition through Reparations. We were looking at how this practice of Spiritual Leadership invites us to bring forward the gifts...By Hilary Allen | July 27, 2023 | From Tending to Tradition